Money may not buy happiness, however financial satisfaction? That's priceless. Yet, too many individuals find themselves bewildered by economic jargon, not sure where to start, or stuck with habits that don't assist their future. If you've ever before felt like saving and spending were made complex or only for the well-off, it's time to move that mindset.

Financial literacy is not concerning being a specialist in stocks or holding an economics level. It's about understanding your money, making it work for you, and sensation positive concerning the options you make. Whether you're simply getting going or seeking to fine-tune your approach, the path to smarter financial savings and investments is more obtainable than you might assume.

Let's dive into the basics of financial proficiency-- and how you can really begin maximizing your financial savings and investment chances today.

The Power of Understanding Where Your Money Goes

Prior to you also think about investing or opening up an interest-bearing account, it's essential to obtain clear on your investing habits. Lots of people think they "do not make enough to save," however usually, the problem lies in exactly how their revenue is being dispersed.

Track your spending for a full month-- every dollar. From your morning coffee to spontaneous online gets, seeing it all outlined can be mind-blowing. As soon as you recognize where your cash is going, you can begin reapportioning funds towards financial savings or debt repayment. Remember, it's not about living without joy-- it's about being intentional.

This clarity helps you build a budget that sustains your goals without feeling limiting. When done right, budgeting can seem like flexibility, not a monetary cage.

Saving with Strategy: More Than Just Tucking Money Away

We've all heard that we should save for a rainy day. Yet just how you save matters. A simple monitoring or typical interest-bearing accounts is a starting factor, yet it's not where your cost savings journey need to finish.

Consider your savings in 3 pails: reserve, short-term objectives, and long-lasting development.

A reserve ought to preferably cover three to 6 months of necessary costs. This protects you from life's curveballs-- work loss, medical expenses, cars and truck repair work-- without needing to depend on credit cards or loans in Moreno Valley that might feature high-interest rates.

For short-term objectives like a getaway, a brand-new gadget, or home enhancement, different savings accounts identified with your details goal can be inspiring and aid you stay on track.

Now, for lasting development, your savings must be functioning harder for you. That's where a high yield savings account business can make a real difference. Unlike conventional interest-bearing accounts, these accounts supply significantly better rate of interest, enabling your money to grow while you rest. It's one of one of the most low-risk methods to make easy earnings on your cost savings without lifting a finger.

Demystifying Investments: No, It's Not Just for the Wealthy

Investing sounds intimidating, but it does not need to be. The reality is, any individual with even a moderate income can start spending and construct riches in time.

The most important rule to remember is: begin early, start small, and remain constant.

Investments aren't practically the stock market. They can consist of pension, realty, mutual funds, and even adding to your kid's education fund. The earlier you start, the more time your cash has to grow via compound passion.

If you're saving for retirement, explore employer-sponsored strategies or explore individual retirement accounts (IRAs). Even if you can only add a small amount monthly, that stable behavior accumulates significantly for many years.

Many people in cities like Corona or Riverside are additionally exploring realty as an investment method. With correct planning, discovering home loans in Corona, CA may open up opportunities to have home, construct equity, or even produce rental earnings. Nonetheless, it's important to do detailed research and understand your obligations as a homeowner prior to diving in.

Structure Credit While Building Wealth

Financial proficiency consists of understanding how credit score jobs. A solid credit rating can unlock chances-- lower rate of interest, faster financing authorizations, far better insurance policy prices-- yet inadequate credit rating can hold you back for years.

The key to healthy and balanced credit scores is consistency. Pay your bills on time. Keep bank card equilibriums low. Avoid opening up numerous new accounts at once. Routinely check your credit rating record to catch errors and track your progression.

Great credit history management sets completely with your savings and financial investment plan. It sustains your capability to secure affordable resources loans in Moreno Valley and even re-finance a home loan when interest rates drop, possibly saving you thousands with time.

The Banking Experience You Deserve

When selecting where to handle your finances, it is necessary to find establishments that offer the tools and adaptability to support your goals. For those living nearby, financial institutions in Riverside, CA frequently supply a series of digital tools and in-person assistance to aid you manage money effectively, whether you're beginning a financial savings plan or preparing to invest.

Regional banks and lending institution sometimes provide much better prices, reduced charges, and an extra personalized approach than big-name financial institutions. Make the effort to ask concerns, explore your choices, and discover a monetary partner that lines up with your goals.

Smart Habits Make All the Difference

Success in saving and investing isn't about luck-- it's about habits. Some of the most intelligent economic actions call for the most basic modifications:

- Set up automatic transfers to your cost savings each time you get paid. Unseen, out of temptation.

- Testimonial your investing regular monthly to determine areas to reduce or enhance.

- Consistently upgrade your monetary objectives. What made good sense in 2015 might not straighten with today's dreams.

- Celebrate tiny victories. Paid off a bank card? Hit a savings landmark? Acknowledge and reward on your own.

As these routines become acquired behavior, you'll observe your self-confidence grow along with your bank equilibrium.

Financial Wellness is a Journey, Not a Destination

There's no single "appropriate means" to handle your money. What issues is progress, not perfection. Everybody's monetary scenario is unique, and your path might look various from others. That's alright.

One of the most important thing is to maintain learning, adjusting, and doing something about it. Small actions taken continually will move you closer to monetary protection-- and eventually, monetary liberty.

Want to know more? We're simply getting going. Follow us for future blog updates and more insights that simplify money management and aid you take charge of your monetary future. Keep tuned, return frequently, and let's keep growing together.

Michael Bower Then & Now!

Michael Bower Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Robbie Rist Then & Now!

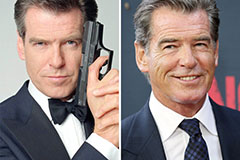

Robbie Rist Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!